Understanding Free Zone Company Setup in the UAE

The UAE has established itself as a global business hub, offering entrepreneurs strategic advantages through specialized economic zones called free zones. These designated areas provide exceptional benefits for foreign investors looking to establish a business presence without the traditional restrictions of mainland company formation.

What Makes Free Zone Company Setup Attractive?

Free zone company setup in the UAE offers distinct advantages that make it particularly appealing for startups, SMEs, and international businesses:

- 100% Foreign Ownership: Free zone companies can be fully owned by foreign nationals without requiring a local UAE partner

- Complete Tax Exemptions: Enjoy 0% corporate tax and 0% personal income tax (with specific exemptions under the new tax regime)

- Full Profit Repatriation: Take home 100% of your profits and capital without restrictions

- Customs Duty Exemptions: Benefit from tax-free imports and exports within the free zone

- Simplified Setup Process: Streamlined incorporation procedures with minimal bureaucracy

- Flexible Visa Options: Attractive visa allocation packages for business owners and employees

These incentives make free zones ideal for businesses focused on international trade, e-commerce, consulting, services, and companies that don't require direct access to the UAE local market.

Key Factors to Consider When Choosing a Free Zone

When searching for the cheapest free zone company setup option in the UAE, consider these critical factors that will impact both immediate costs and long-term business operations:

1. Business Activity Compatibility

Free zones typically specialize in specific industry sectors such as logistics, media, IT, or finance. Your selected free zone must permit the business activities you intend to conduct. Misalignment between your business activities and free zone specialization can lead to operational challenges and potential license restrictions.

2. Location Strategy

The geographic position of your free zone can significantly impact your operational efficiency:

- Proximity to Markets: Consider how close you need to be to your target customers

- Logistics Considerations: For trading businesses, access to ports and transport hubs is critical

- Client Accessibility: Some businesses require convenient locations for client meetings

- Employee Commute: Location impacts your ability to attract and retain talent

3. Cost Structure Analysis

Beyond the headline license fees, conduct a thorough cost analysis including:

- License Fees: Initial and renewal costs vary significantly between free zones

- Office Requirements: Physical office vs. virtual office options and their associated costs

- Visa Allocation: Number of visas included and additional visa costs

- Service Charges: Annual fees, administrative costs, and other operational expenses

4. Infrastructure and Facilities

Evaluate the infrastructure quality and available facilities:

- Office Spaces: Types, sizes, and flexibility of workspace options

- Technical Infrastructure: Quality of internet connectivity and IT services

- Support Services: Available business support and administrative assistance

- Amenities: Access to meeting rooms, conference facilities, and business centers

Top 4 Cheapest Free Zones for UAE Company Setup in 2025

After analyzing over 40 free zones across the UAE, we've identified the most cost-effective options that deliver exceptional value for entrepreneurs and small businesses with budget constraints.

1. International Free Zone Authority in Dubai (IFZA)

IFZA has emerged as one of the most affordable options for free zone company setup, particularly appealing to startups and SMEs due to its streamlined processes and competitive pricing structure.

Key Advantages:

- Fast-track business setup with minimal documentation requirements

- Extensive range of permitted business activities across multiple sectors

- Flexible office solutions including virtual office options

- Competitive license packages with cost-effective renewal terms

- Strategic location with good connectivity to Dubai's business districts

Ideal For: Service-based businesses, consultancies, trading companies, and digital enterprises that don't require physical retail presence.

2. Sharjah Media City Free Zone (SHAMS)

SHAMS has positioned itself as a budget-friendly free zone focused on media, creative industries, and technology sectors. Its affordability combined with strategic location has made it increasingly popular among entrepreneurs seeking cost-effective business setup solutions.

Main Benefits:

- Extremely competitive pricing for service-oriented businesses

- No physical office space requirement for certain license types

- Efficient licensing process with rapid approval timelines

- Affordable visa packages for business owners and employees

- Supportive ecosystem for creative and media enterprises

Perfect For: Media professionals, content creators, marketing agencies, technology startups, and freelancers operating in creative fields.

3. Ras Al Khaimah Economic Zone (RAKEZ)

RAKEZ offers one of the most cost-effective and versatile business setup solutions in the northern emirates. Catering to a wide spectrum of industries from manufacturing to trading and consultancy services, RAKEZ provides affordable licensing options with comprehensive business support.

Key Advantages:

- Low-cost license packages across industrial, commercial, and service categories

- Access to industrial land and warehouse facilities at competitive rates

- Business-friendly regulations with minimal bureaucracy

- Strategic location with excellent logistics infrastructure

- Cost-effective visa processing and allocation

Especially Suitable For: Manufacturing businesses, trading companies, logistics operations, and industrial enterprises requiring warehouse facilities.

4. Ajman Free Zone

As one of the UAE's established free zones, Ajman Free Zone has consistently offered affordable company formation packages while maintaining high-quality services. Its proximity to Dubai combined with significantly lower costs makes it attractive for budget-conscious entrepreneurs.

Key Advantages:

- Substantially lower license fees compared to Dubai-based free zones

- Strategic location with easy access to UAE's major ports and markets

- Attractive visa packages for business owners and staff

- Flexible office solutions including shared and virtual options

- Excellent support services for business setup and operations

Best For: Trading companies, service providers, small manufacturers, and businesses that benefit from port proximity.

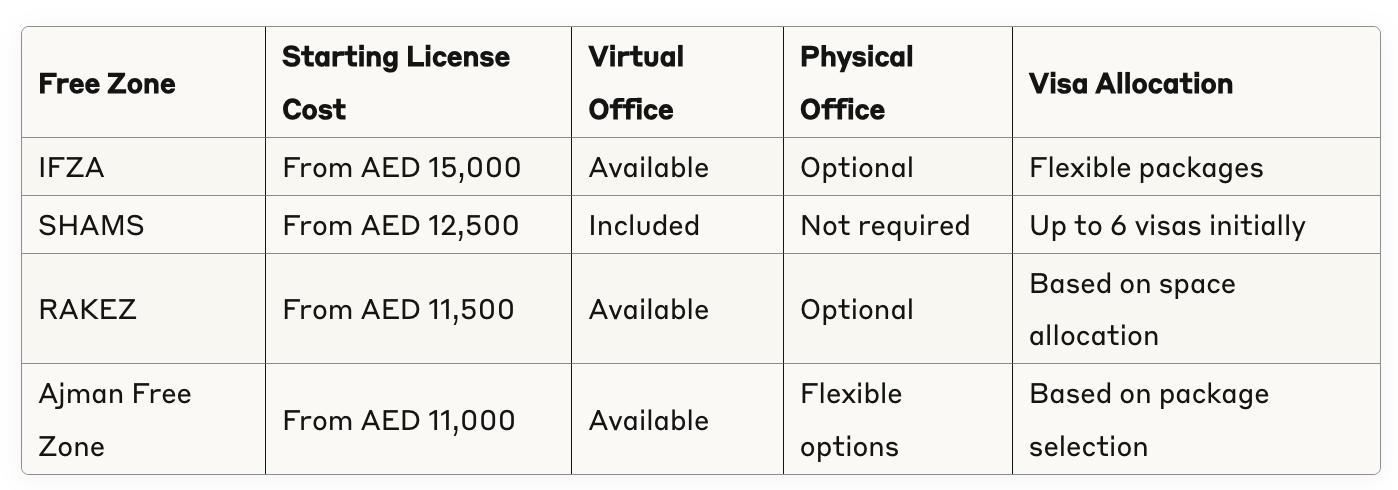

Comparative Cost Analysis of UAE's Cheapest Free Zones

When evaluating the most affordable free zones, consider these approximate starting costs (as of 2025) for basic license packages:

Note: Prices are subject to change and may vary based on business activity, package selection, and special promotions.

How to Choose the Right Free Zone for Your Business

While cost is a primary consideration, selecting the optimal free zone requires a comprehensive approach:

1. Business Activity Assessment

Ensure your chosen free zone permits your specific business activities without restrictions. Some free zones specialize in certain industries and may offer additional benefits for businesses in those sectors.

2. Total Cost Calculation

Look beyond the headline license fee and calculate the total cost of operation including:

- License and registration fees

- Office space requirements

- Visa costs for yourself and employees

- Banking and financial service costs

- Annual renewal fees and compliance costs

3. Long-term Business Strategy Alignment

Consider how your free zone choice aligns with your long-term business objectives:

- Scalability options for future growth

- Potential for business expansion

- Network and partnership opportunities

- Access to target markets and customers

- Industry-specific benefits and support

4. Professional Consultation

Engage with specialized business setup consultants who can provide:

- Customized free zone recommendations based on your specific business model

- Updated information on regulatory requirements and costs

- Assistance with documentation and application processes

- Guidance on optimizing your business structure for maximum benefits

The Business Setup Process in UAE Free Zones

Setting up a company in a UAE free zone typically follows these key steps:

- Select Your Free Zone: Based on business activity, budget, and strategic requirements

- Choose Your Legal Structure: Free zone establishment (FZE), free zone company (FZC), or branch office

- Reserve Company Name: Ensure your desired name complies with UAE naming conventions

- Prepare Documentation: Including business plan, shareholder documents, and application forms

- Submit Application: Apply for initial approval from the free zone authority

- Receive Initial Approval: Typically issued within 1-2 business days

- Sign Legal Documents: Complete all required agreements and documentation

- Pay License and Registration Fees: Cover all required costs for company formation

- Receive License and Registration: Obtain your business license and commercial registration

- Open Corporate Bank Account: Establish banking relationships for your business

- Apply for Visas: Process residence visas for yourself and eligible employees

Conclusion: Making the Right Choice for Your UAE Free Zone Company Setup

The UAE continues to offer some of the world's most attractive business environments through its innovative free zone structure. While cost remains a significant factor for entrepreneurs and SMEs, the right free zone should balance affordability with strategic benefits that support your business objectives.

IFZA, SHAMS, RAKEZ, and Ajman Free Zone represent excellent options for cost-effective company formation, each with distinct advantages designed for different business types and operational needs.

With proper research, strategic planning, and professional guidance, establishing your business in a UAE free zone can provide the perfect foundation for sustainable growth and international expansion. The combination of tax benefits, 100% foreign ownership, strategic location, and world-class infrastructure makes UAE free zones an unparalleled opportunity for global entrepreneurs.